CMSC

0.1400

As European capitals prepare to implement long-awaited sanctions on Russia's diamond exports, Belgian traders are bracing for new scrutiny of their industry.

In Antwerp's renowned diamond district -- which handles an estimated 86 percent of the world's rough diamonds -- polishing "labs" are turning to blockchain technology to prove their gemstones come from legitimate mines in Africa, Australia or Canada, and not Russia.

With Russian stones having accounted for around a third of the global market before Moscow's 2022 invasion of Ukraine, the G7's decision to ban trade in them could have broad repercussions.

Industry insiders in Belgium expect the sanctions to be phased in gradually, limiting market disruption.

Meanwhile, major traders and jewellery brands have begun adopting advanced tracking technology to check and certify where their diamonds are coming from.

The industry has sought to burnish its image ever since outrage erupted two decades ago over so-called "blood diamonds" financing brutal civil wars in Africa.

If traders are now seen helping Russia evade sanctions to keep financing its invasion of Ukraine, the shine may come off diamonds once again.

The European Union is drawing up bans on Russian diamonds as part of its 12th package of sanctions to tighten the vice on Moscow's war economy and cut off funds the country is using to buy munitions and drones from North Korea and Iran.

But it has been difficult to agree on how best to restrict the diamond trade. Being small and extremely valuable, gems are simple and lucrative to smuggle.

They can easily be mixed with stones from other sources. In addition, rough diamonds change weight and appearance as they are cut, polished and eventually set in jewellery.

- Draft sanctions -

Europe -- and Belgium in particular -- has another concern: Even with EU sanctions, Russian gems could still find their way to competitors in places like Dubai and India.

As EU sanctions talks progressed, the G7 powers stepped in and the world's top industrialised democracies agreed a global ban.

"I think it is important that any traceability solution, or any protocol that is proposed to deal with those potential sanctions, is industry-wide and is supported by all the diamond centres," said iTraceiT CEO Frederik Degryse.

Degryse's firm is trying to provide market players with a digital way to trace their supply chain.

The European Commission has adopted a proposal that will go to member states for approval, expected in the coming days if the 27 member states are unanimous.

According to a copy seen by AFP, it will ban trade in diamonds originating in, transiting, or exported from Russia, as well as Russian diamonds cut and polished in third countries.

Starting January 1 2024, the ban would apply to "non-industrial natural and synthetic diamonds as well as diamond jewellery."

The import ban on Russian diamonds cut or polished in third countries would be phased in between March and September next year.

"This phasing-in... takes into consideration the need to deploy an appropriate traceability mechanism that enables effective enforcement measures and minimises disruptions for market players," the draft says.

The iTraceiT firm believes its technology would ease the supply chain disruption such bans might bring.

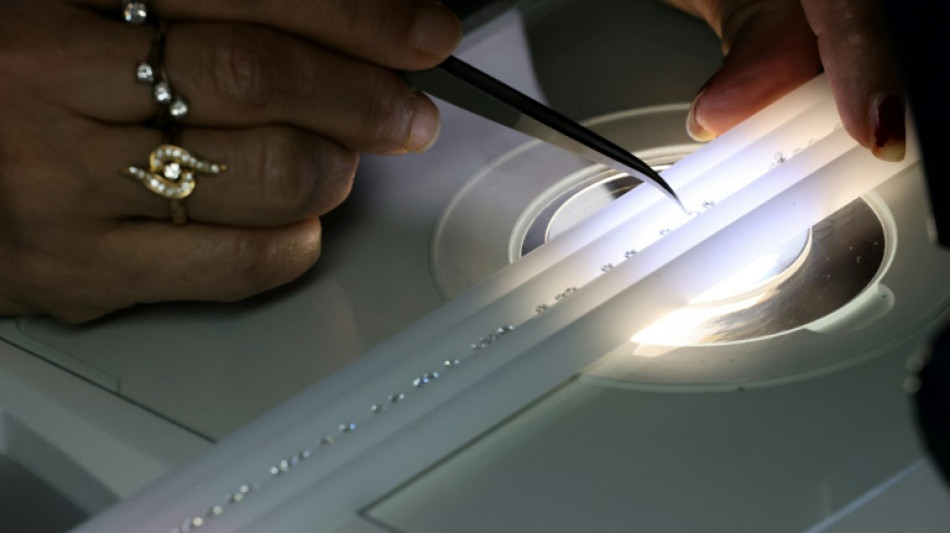

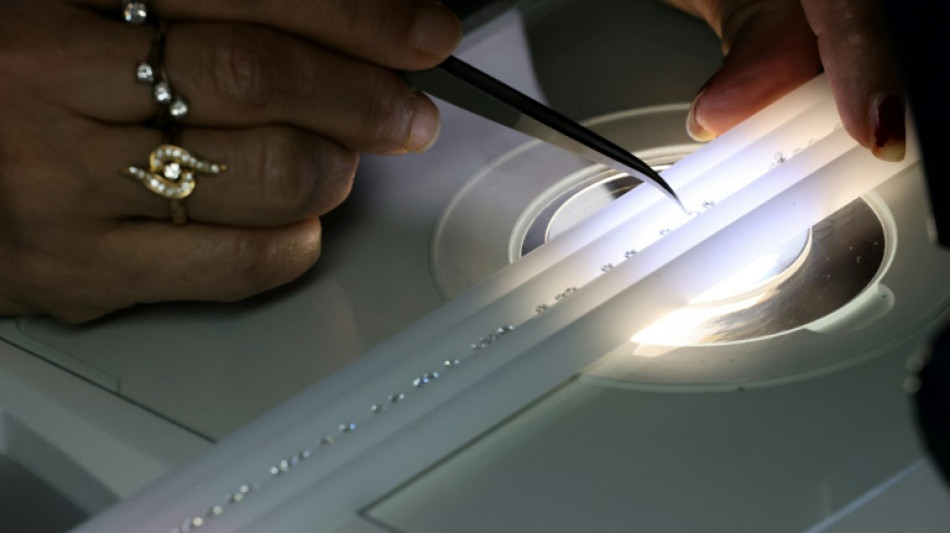

In a "lab" in Antwerp's diamond quarter, account manager Sandiah Kangoute showed AFP how miners, traders, polishers and retailers can trace their diamonds back to their source.

As miners bag stones, each is assigned a QR code linking its contents to a unique filing system using blockchain technology -- a method of recording information that is difficult to hack or manipulate.

Using a code reader, industry workers can access files attached to the unique codes and add new ones, such as receipts for purchase, export licences, and certificates of authenticity.

"So I see here, the starting point was Canada, then it travelled and is coming to me in France," Kangoute says, as she scans a QR code on a small packet of cut diamonds.

- Every parcel tracked -

If challenged, exporters can use the iTraceiT system to provide back-up evidence to prove their diamonds are not sourced from Russia.

"Every parcel or every diamond will have an internal reference, which is linked," Degryse said.

"So if there's any deviation between the actual physical diamonds that you're weighing and the numbers that are there, then it'll pop up," he said.

"And then you have all the supporting documentation," Degryse added.

"All the partners that we work with get audited on a frequent basis. So this is a tool that can make it easier for auditors to go in and see traceability for all the diamonds."

But will the sanctions hurt Russia? So far, it has managed to maintain its war against Ukraine through 11 previous rounds of EU measures that targeted its much larger oil and gas exports.

The industry is sceptical. Russia is a major source of diamonds, but diamonds themselves account for a small part of its economy, and this might in part explain why officials took so long to get around to tackling the trade.

K.Yoshida--JT